All Categories

Featured

Table of Contents

This plan layout is for the client that requires life insurance policy however want to have the capability to choose exactly how their money value is spent. Variable plans are underwritten by National Life and distributed by Equity Providers, Inc., Registered Broker/Dealer Associate of National Life Insurance Policy Company, One National Life Drive, Montpelier, Vermont 05604.

A whole life insurance policy policy covers you permanently. It has cash worth that grows at a set rates of interest and is the most common sort of permanent life insurance policy. Indexed global life insurance policy is also permanent, yet it's a particular type of universal life insurance policy with money value linked to a securities market index's efficiency instead of non-equity gained prices. The insurance company will pay out the face amount directly to you and terminate your plan. Contrastingly, with IUL policies, your survivor benefit can raise as your money worth expands, bring about a potentially greater payout for your recipients.

Discover regarding the several advantages of indexed universal insurance coverage and if this sort of policy is ideal for you in this insightful post from Protective. Today, many individuals are looking at the worth of long-term life insurance policy with its capacity to offer long-term security in addition to money value. indexed universal life (IUL) has actually become a prominent selection in offering long-term life insurance policy defense, and an also better possibility for development via indexing of passion credit reports.

How does Iul Accumulation work?

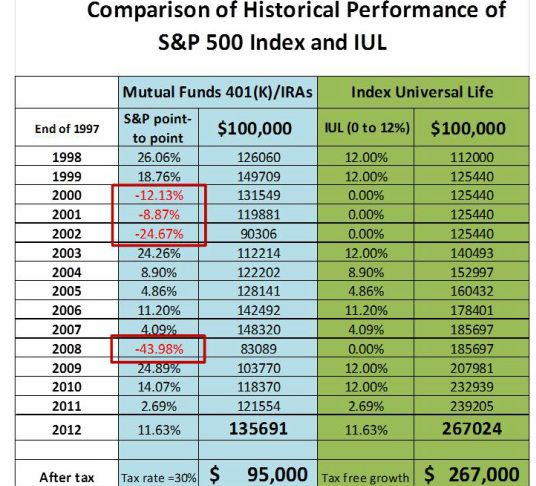

Nonetheless, what makes IUL different is the way passion is attributed to your policy. Along with using a conventional proclaimed rate of interest rate, IUL provides the possibility to make interest, subject to caps and floorings, that is connected to the performance of a chosen option of market indices such as the S&P 500, Dow Jones Industrial Average or the Nasdaq-100.

With IUL, the insurance holder chooses the quantity designated among the indexed account and the dealt with account. Just like a regular global life insurance policy plan (UL), IUL permits for a flexible premium. This suggests you can choose to contribute even more to your plan (within government tax regulation limits) in order to assist you develop your cash money value even faster.

As insurance coverage with investment-like features, IUL policies charge compensations and charges. These fees can reduce the cash value of the account. While IUL plans additionally supply guaranteed minimum returns (which might be 0%), they also top returns, even if your select index overperforms (Indexed Universal Life death benefit). This means that there is a limitation to price of cash money value development.

Created by Clifford PendellThe pros and disadvantages of indexed universal life insurance policy (IUL) can be challenging to understand, especially if you are not knowledgeable about how life insurance functions. While IUL is among the most popular items on the market, it's also one of the most unpredictable. This kind of coverage may be a feasible choice for some, but also for most individuals, there are better alternatives avaiable.

What does a basic Iul Cash Value plan include?

In addition, Investopedia checklists tax obligation benefits in their benefits of IUL, as the fatality advantage (cash paid to your beneficiaries after you pass away) is tax-free. This is real, yet we will include that it is additionally the instance in any type of life insurance coverage plan, not simply IUL.

The one point you require to understand about indexed universal life insurance policy is that there is a market risk included. Investing with life insurance coverage is a different game than buying life insurance to safeguard your family members, and one that's not for the pale of heart.

For example, all UL products and any kind of general account item that depends on the performance of insurance firms' bond profiles will undergo rates of interest risk."They continue:"There are fundamental dangers with leading clients to believe they'll have high rates of return on this item. As an example, a customer might slack off on funding the money value, and if the plan does not do as expected, this can cause a gap in insurance coverage.

And in 2020, Forbes released and short article entitled, "Sounding the Alarm on Indexed Universal Life Insurance Policy."Despite hundreds of posts cautioning consumers about these policies, IULs continue to be one of the top-selling froms of life insurance policy in the United States.

What should I look for in a Indexed Universal Life Tax Benefits plan?

Can you manage seeing the stock index execute improperly understanding that it straight impacts your life insurance and your capacity to secure your household? This is the last intestine check that hinders even extremely well-off capitalists from IUL. The entire point of purchasing life insurance policy is to minimize risk, not produce it.

Discover more regarding term life here. If you are searching for a plan to last your entire life, take an appearance at assured global life insurance policy (GUL). A GUL policy is not practically long-term life insurance policy, but rather a crossbreed in between term life and global life that can enable you to leave a legacy behind, tax-free.

Your price of insurance policy will certainly not alter, even as you obtain older or if your health changes. You pay for the life insurance coverage defense just, simply like term life insurance coverage.

What should I know before getting Indexed Universal Life Insurance?

Surefire universal life insurance policy is a portion of the expense of non-guaranteed global life. You do not run the danger of shedding protection from unfavorable investments or adjustments on the market. For a comprehensive contrast in between non-guaranteed and assured global life insurance coverage, go here. JRC Insurance Policy Group is below to help you locate the best plan for your needs, with no additional price or fee for our aid.

We can fetch quotes from over 63 premier providers, allowing you to look beyond the big-box business that usually overcharge. Obtain begun now and call us toll-free at No sales pitches. No pressure. No responsibilities. Consider us a good friend in the insurance policy industry who will keep an eye out for your finest passions.

Why is Iul For Wealth Building important?

He has actually aided thousands of households of services with their life insurance coverage needs since 2012 and specializes with candidates that are much less than ideal health and wellness. In his leisure he takes pleasure in hanging out with household, traveling, and the outdoors.

Indexed global life insurance can aid cover several economic requirements. It is just one of several kinds of life insurance policy readily available.

Table of Contents

Latest Posts

Whole Life Vs Iul

Cap Life Insurance

Universal Life Insurance Vs Term Life

More

Latest Posts

Whole Life Vs Iul

Cap Life Insurance

Universal Life Insurance Vs Term Life